Discover Next Level Payroll

Watch and see how we’ve taken your payroll to the next level.

Topics Covered:

- Inputs – your employee info

- Calculations – all done for you

- Happy employees – right every time

- Pension – powering up pensions

- Savings – how we’ve saved you £3,000

- Payments – make yours painless

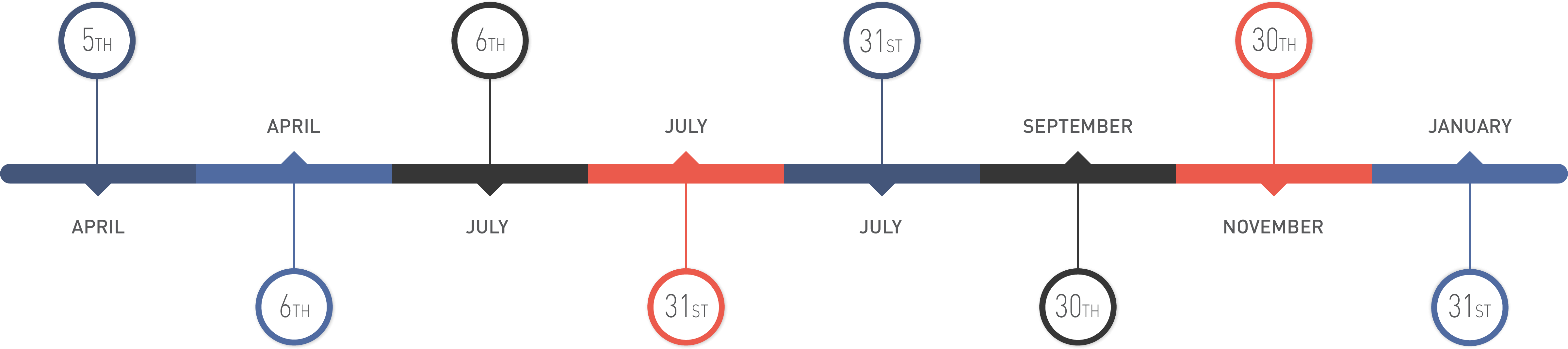

YOUR PERSONAL TAX TIMELINE

Previous Tax Year Finishes (all dividends, salary, interest etc included upto this date)

New Tax Year Starts

Benefits: (P11d) filing deadline. If you have any you should get a copy this month.

Payment: deadline to pay your 2nd payment on account (if you have any)

Request: we will ask for you personal tax records by now

Deadline: for receiving your personal tax records, the earlier the better however so we can calculate the tax you owe and let you know well in advance, getting records after this date may mean your return isn’t ready much before the January deadline and/or we may charge a premium

Deadline: the last date for when we would like to have your personal tax produced and filed for you, hopefully well before!

Deadline: for filing and paying your personal tax

QUICK LINKS

We can make your payroll the easiest part of running your business by taking control of your payments too. All you need to do is click one button when we send it for review.

We automatically check whether you are eligible for employers allowance, potentially saving you £3,000 per year without having to lift a finger.