Discover Next Level Payroll

Watch and see how we’ve taken your payroll to the next level.Topics Covered:

- Inputs – your employee info

- Calculations – all done for you

- Happy employees – right every time

- Pension – powering up pensions

- Savings – how we’ve saved you £3,000

- Payments – make yours painless

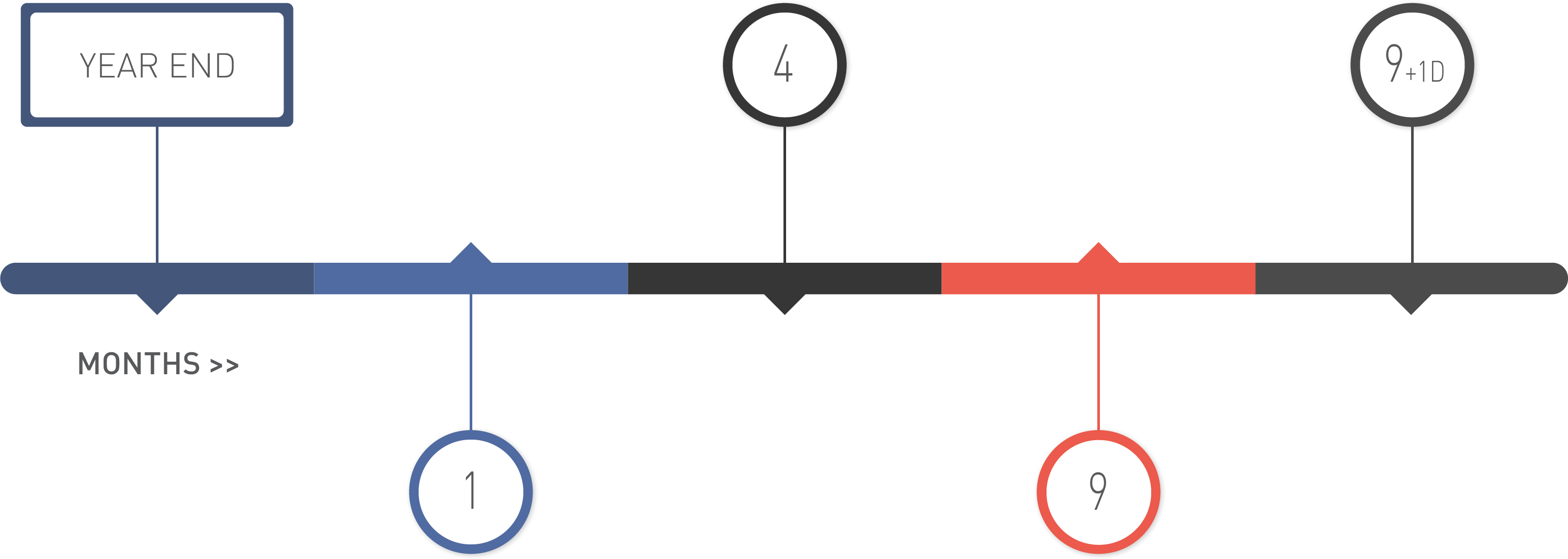

YOUR ANNUAL ACCOUNTS TIMELINE

Prepare: your companies year end will have just finished, time to submit receipts, expenses and raise final invoices and credit notes

Request: around a month after your year end (to allow for bank statements etc to be generated) we will send a request for your year end information so we can start to prepare your accounts and tax returns

Deadline: if we get all your information promptly we aim to complete and have filed your accounts and tax returns within 4 months of the year end so you know your tax payment well in advance. Complex accounts may take a little longer.

Deadline: the last date to submit your accounts to companies house and tax return to HMRC

Pay: deadline to pay your corporation tax

Quick Links

ONE CLICK PAYROLL…

We can make your payroll the easiest part of running your business by taking control of your payments too. All you need to do is click one button when we send it for review.

We automatically check whether you are eligible for employers allowance, potentially saving you £3,000 per year without having to lift a finger.