Watch to find out more about your Next Level VAT return

Topics Covered:

- Your VAT Return – A guide to your return

- Money – How we’ve saved you money

- Peace of Mind – Stress free VAT

- Brilliant Books – Managing your data

- Saving Time – Automating your business

- Next Steps – What will happen now

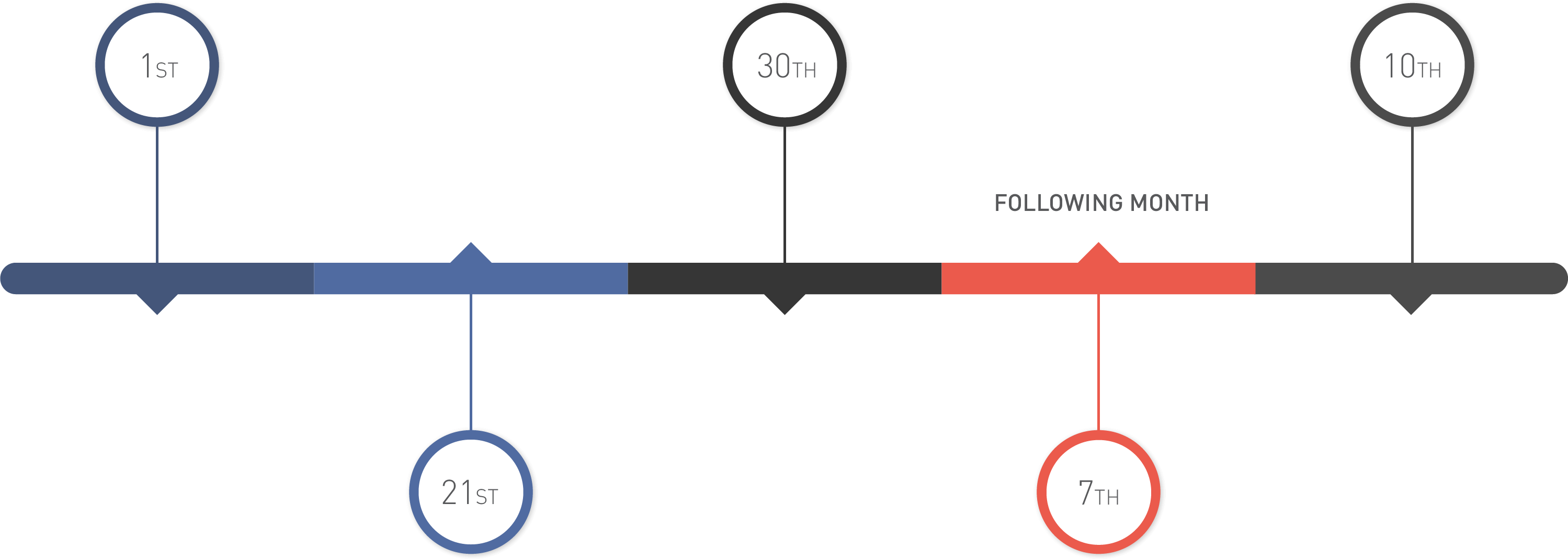

YOUR VAT TIMELINE

(click dates for more info)

Just finished your VAT period, time to submit receipts, expenses and raise final invoices and credit notes

We aim to have all VAT returns with you for review by this date

Our internal deadline for approval and filing with you

Deadline for filing VAT return and paying manually

Payment via direct debit (an extra few days grace!)

Quick Links

TIP 7: VAT ON MILEAGE…

You can claim VAT back on the fuel part of mileage claims if you wish. Ensure you record your vehicle engine size and fuel type on claims to look up the advisory fuel rate for the car and keep petrol receipts which show enough fuel used.

You can claim VAT back on the fuel part of mileage claims if you wish. Ensure you record your vehicle engine size and fuel type on claims to look up the advisory fuel rate for the car and keep petrol receipts which show enough fuel used.

TIP 1: ASK…

Always ask for a VAT receipt when you buy anything. Even a £3 coffee has 50p of VAT on it. One coffee a day is £130 saved a year!

Always ask for a VAT receipt when you buy anything. Even a £3 coffee has 50p of VAT on it. One coffee a day is £130 saved a year!

TIP 2: BAD DEBT…

No one likes bad debt. Take the sting out of it to the tune of 39% by claiming back any VAT (20%) on bad debts and reduce your corporation tax (19%). Speak to your client manager.

No one likes bad debt. Take the sting out of it to the tune of 39% by claiming back any VAT (20%) on bad debts and reduce your corporation tax (19%). Speak to your client manager.

TIP 3: TAX ACCOUNTS…

Setup a separate bank account for taxes in your business. Put a third of anything that you get paid into it to cover VAT and Corporation tax and never worry about taxes again.

Setup a separate bank account for taxes in your business. Put a third of anything that you get paid into it to cover VAT and Corporation tax and never worry about taxes again.

TIP 4: PERSONAL & ENTERTAINMENT…

You can’t claim VAT back for business entertainment expenses or personal expenses. Staff entertainment however you can. We help you get this right every time.

You can’t claim VAT back for business entertainment expenses or personal expenses. Staff entertainment however you can. We help you get this right every time.

TIP 5: AMAZON…

Love Amazon? We do too. Set Up a business account to separate business purchases and also ensure you get VAT receipts for everything you buy. A £1,000 laptop is hiding £167 of VAT to reclaim. Better for everyone!

Love Amazon? We do too. Set Up a business account to separate business purchases and also ensure you get VAT receipts for everything you buy. A £1,000 laptop is hiding £167 of VAT to reclaim. Better for everyone!

TIP 6: EMPLOYEE EXPENSES…

Employee expenses can be a minefield. Ensure you employees ask for and submit VAT receipts to minimise the cost to you. At only £50 of expenses per month this could save you upto £100 per year per employee.

Employee expenses can be a minefield. Ensure you employees ask for and submit VAT receipts to minimise the cost to you. At only £50 of expenses per month this could save you upto £100 per year per employee.