Get ready for a lesson in debt finance options

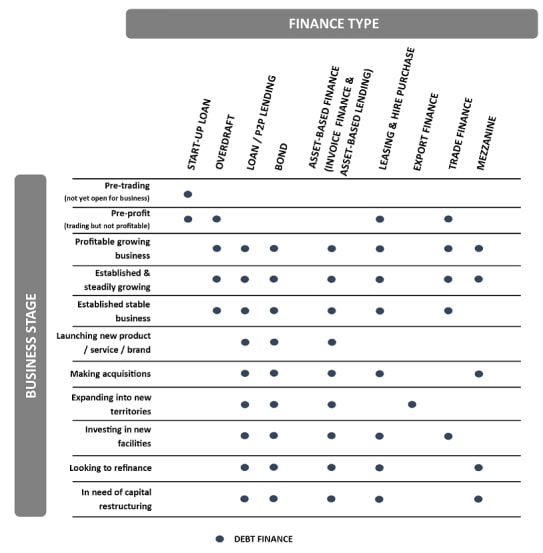

As discussed in the Business Finance Journey, there are various debt finance options available to businesses at different stages.

Debt Finance

Just as short-term capital should not be used to fund long-term plans, so the reverse is true. On the financing journey, it is highly likely that you will need both, and the task is to get the right mix.

Debt will undoubtedly be involved in growing a business. Debt comes in many forms, each of which can be more or less appropriate to the type of business, the stage it is at in its development or the plans it has to grow. An established company will use a blend of different debt products from a range of providers.

Debt, in its simplest form, is an arrangement between borrower and lender. A capital sum is borrowed from the lender on the condition that the amount borrowed is paid back in full either at a later date, multiple dates or over a period of time. Interest is accrued on the debt and paid independently of the capital repayment schedule.

Unlike equity, debt does not involve relinquishing any share in ownership or control of a business. However, a lender is far less likely to help a business hone its strategy than a business angel or VC investor.

From the image above we can quickly identify which ones could be right for you. Take a look at the debt finance options available for your business, then get in touch and we can advise which would work for you.

Debt, in its simplest form, is an arrangement between borrower and lender

Debt Options

Overdrafts & Loans

Overdrafts are often what a business uses to help day-to-day short-term requirements and as it grows incrementally. Loans, leasing or hire purchase agreements are in most cases better suited to larger longer-term purchases, such as investment in plant and machinery, computers or transport.

To obtain a loan or overdraft, management must prove to the lender that the business will generate the income and cash to both repay the facility according to the terms of the loan and service the loan by meeting interest payments. Market conditions and regulatory requirements may also impact the ease with which a business can access a loan or overdraft.

It is likely that the business will need to provide security for any money borrowed against other personal or business assets.

P2P Lending

One major innovation going on in the supply of debt to businesses is P2P business lending. This is where internet-based platforms are used to match lenders with borrowers. The UK is at the forefront of innovation in this growing form of alternative online finance.

P2P business lending is a direct alternative to a bank loan. It can often be more quickly arranges and it will also allow partners, customers and friends/family who invest through the platform to share in the returns of the business. The minimum loan size is very small, which encourages a wide range of lenders to participate, the maximum loan size of P2P lending is growing.

The Financial Conduct Authority (FCA) regulates P2P lending.

Bond

Bonds, retail bonds or corporate bonds, are a way for companies to borrow money from investors in return for regular interest payments. They have a predetermined ‘maturity’ date when the bond is redeemed and investors are paid their original investment.

Traditionally, corporate bonds and retail bonds would be traded on the stock market, but available now are mini-bonds. Mini-bonds are similar, but crucially, they are not traded on a stock market and can only be promoted to certain types of investor.

Asset Based Lending

Asset-based lending is used to obtain a wide range of items for your business – everything from telephones to vehicles.

Because the loans are secured wholly or largely against the asset being financed, the need for additional collateral is much reduced and there is more security for the user because the loan cannot be recalled during the life of the agreement. Asset finance also offers ultimate flexibility because businesses have the option to replace or update equipment at the end of the lease period.

Cashflow is King

Talk to us so we can tailor business advice that’s best for you and the growth of your business.

Invoice Finance

Invoice finance includes invoice factoring, funding provided against outstanding debts.

Invoice finance can be used to support cash flow and release funding for investment by generating money against unpaid invoices. Invoice finance is available to businesses that sell products or services on credit to other businesses.

There are many sub-varieties of Invoice Finance dependent on the position of each individual business. We are partnered with Market Invoice.

The Market Invoice platform gives your business a way to get paid for outstanding invoices before your customer actually sends over funds. If your business sells into large organisations, you’ll know how painful it is to wait for your invoices to be paid. Payment terms as long as 90-120 days cause inevitable issues with cash flow. With MarketInvoice you can access money tied up your outstanding invoices upfront. Using the online peer-to-peer network you can sell single invoices online, as and when you need to, with no contracts, hidden fees or personal guarantees.

Get in touch to find out more.

Export Finance

When businesses export, they need to be sure they can afford to produce the goods and that they will be paid. Export finance helps mitigate risks such as default or delayed payment.

Manufacturers who import raw materials face other challenges. Overseas suppliers want to be paid for materials before shipping, so the need arises for finance to fill that gap between importing raw materials and the point to which the finished product is sold. That’s where export finance comes in.

There are many tools available encompassed within export finance including Bonds & Guarantees and Letters of Credit.

Trade Finance

Funding that assists businesses in purchasing goods, whether from international or domestic sellers, is termed trade finance. It is often transactional, with finance only being provided for specific shipments of goods and for specific periods of time.

Here the asset being funded against is the goods themselves (as opposed to invoices) and until repaid by the client, the goods belong to the finance provider.

Mezzanine Finance

This is a form of debt which shares the characteristics of equity but ranks below senior debt. Mezzanine is a flexible product that can be tailored to the risk and repayment profile of the business or transaction. It is typically used to finance the expansion of existing companies by VC investors.

Basically debt capital, it gives the lender the rights to convert to an ownership or equity interest in the company if the loan is not paid back on time and in full.

What’s The Next Step In Financing Your Business?

Now you’ve learnt about the different forms of debt finance options available, make sure you are aware of the Equity Finance Options available to your business.

What makes us

different?

We are your entire finance department—bookkeeping, specialists, software, and processes— at a fraction of the cost of building a dedicated department.

Industry Experts

Our finance and accounting experts are focused on helping you manage growth and reach your goals. Get a dedicated finance function with expertise in your industry.

We Scale

Our finance function and level of support grow with your business needs. Whether just starting out or already international, you’ll find us competitive for the services our clients find invaluable.

Strategy

Our finance experts offer support from operations to strategy. We bring our experience from large public companies to ambitious, high-potential, high-growth businesses like yours.

Cohesion

We plan for the complexities of internationalisation, fundraising and managing growth. Our consistency brings clarity and speed to decision-making for you.

Tech Provided

Our team designs and operates high-tech finance functions for many growing businesses. Draw on our accumulated experience and achieve best practices and efficiency.